Take control of your credit. Take back your life.

Errors, collection notices, and outdated accounts don’t have to define your future. Juno Credit Solutions helps you dispute inaccuracies, protect your rights, and create a clear path to rebuilding your credit through a consumer credit audit, giving you the right insights to rebuild credit score effectively. Enroll today through our secure checkout and client portal. Simple, compliant, and focused on credit score recovery.

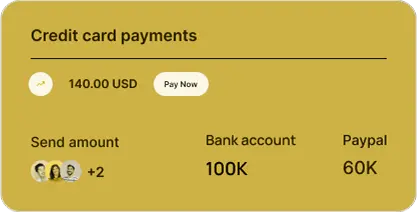

You’ll only be billed 5 days after your review, giving you time to see our process in action before payment.

Not Just Your Credit — It’s Your Life.

At Juno Credit Solutions, we know bad reporting and debt collection affect more than a score. They affect your peace of mind, your opportunities, and your future. That’s why we fight for more than credit repair plan — we fight for you with our commitment to FDCPA debt validation and compliant credit repair. Enroll today through our secure checkout and client portal. Simple, compliant, and transparent.

You’ll only be billed 5 days after your review, giving you time to see our process in action before payment.